- For students, managing finances can often feel like a daunting task. Whether it’s balancing the cost of tuition, textbooks, groceries, and living expenses, it can quickly spiral out of control.

- However, financial literacy is essential, and today, there are numerous tools that can help students stay on top of their finances. One of the most effective ways to take charge of your finances is through budgeting apps for students, which can assist with everything from everyday budgeting to investing

- In this comprehensive guide, we’ll explore 6 must-have apps for students to manage their finances. These apps are not only great for managing your budget but also for helping you save money and even begin investing early on. Let’s dive into how these apps can simplify students budgeting while ensuring that you are in control of your financial future.

Click Here : How to Use Perplexity AI 2025

1. Mint: The Ultimate Budgeting Tool for Students

- When it comes to managing finances, Mint is one of the most popular and versatile budgeting apps for students.

- Mint offers an easy-to-use, all-in-one solution for tracking income and expenses. It can connect to your bank accounts, credit cards, loans, and even investment accounts to give you a full picture of your financial life.

- This comprehensive app is perfect for students who want to consolidate their finances in one place and get a detailed breakdown of where their money is going.

Features of Mint:

- Expense Categorization: Mint automatically categorizes your transactions (e.g., groceries, dining out, entertainment, etc.), making it easy to track spending.

- Budgeting & Alerts: The app allows you to create customized budgets for different categories and sends notifications when you’re nearing or exceeding your budget limits.

- Bill Reminders: Mint keeps track of bills and provides timely reminders to ensure that you never miss a payment or incur late fees.

- Free Access: Mint is entirely free to use, which is a big plus for students on a tight budget.

For students who want a free, user-friendly app that simplifies the process of students budgeting, Mint is an excellent choice. It provides essential tools for managing money effectively, making it one of the best budgeting apps for students.

2. YNAB (You Need a Budget): Take Control of Your Finances

- If you’re serious about getting your finances in order, YNAB (You Need a Budget) is one of the most powerful budgeting apps for students available. Unlike other budgeting tools that simply track your spending, YNAB encourages a proactive approach to budgeting.

- It follows a zero-based budgeting method, which means every dollar you earn has a purpose and is allocated to a specific category (e.g., rent, savings, fun money, etc.).

Features of YNAB:

- Zero-Based Budgeting: Every dollar you earn is assigned a job, ensuring that you’re intentional about your spending and saving.

- Goal Tracking: You can set up specific financial goals, like saving for textbooks, a trip, or an emergency fund, and YNAB will help you track your progress.

- Educational Resources: YNAB offers tons of helpful videos and articles to guide you in learning how to budget effectively, making it great for students who are new to personal finance.

- Syncing Across Devices: YNAB syncs across all your devices, allowing you to track your finances in real-time no matter where you are.

While YNAB comes with a subscription fee, many students find that the cost is well worth the investment, especially if you want to take budgeting to the next level. With its powerful tools, YNAB is a great choice for students serious about learning the principles of students budgeting.

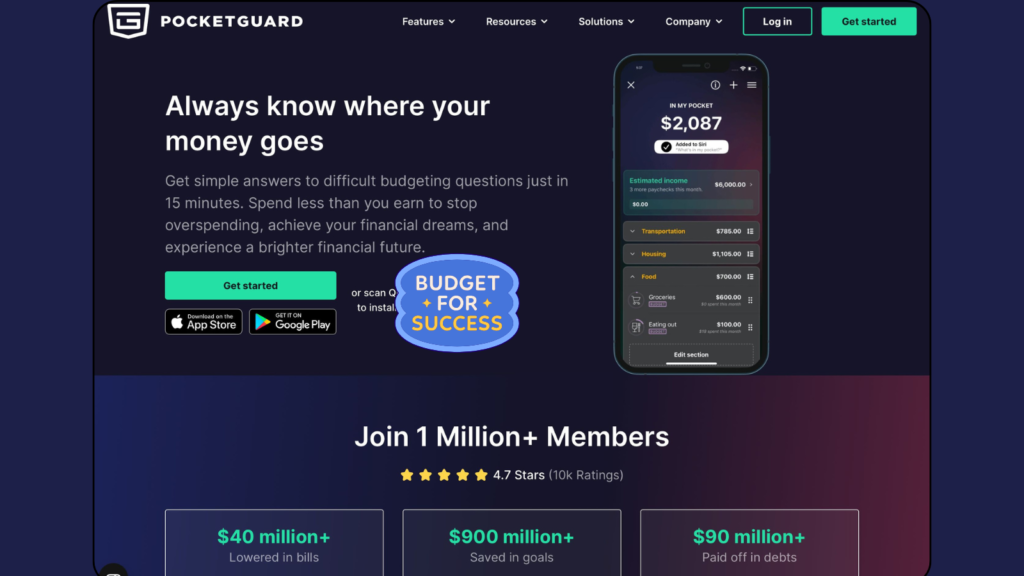

3. PocketGuard: Stay on Top of Your Spending

- One of the main challenges of students budgeting is figuring out how much money you can actually spend after paying for bills and saving for future goals. PocketGuard simplifies this process by showing you how much “safe-to-spend” money you have left after all of your expenses are accounted for.

Features of PocketGuard:

- Safe-to-Spend: This feature shows you exactly how much disposable income you have available after your bills and savings goals are deducted from your account balance.

- Expense Tracking: PocketGuard automatically tracks your spending across different categories like food, entertainment, and transportation.

- Bill Reminders: Similar to Mint, PocketGuard sends reminders for upcoming bills to help you stay on track.

- Cash Flow Insights: The app gives you detailed insights into your cash flow, helping you understand how money is coming in and going out.

For students who want a simple way to track spending without the complexity of detailed budgeting, PocketGuard is one of the best apps to track spending for students. It offers a straightforward approach to students budgeting, helping students make informed spending decisions

4. Acorns: Invest Your Spare Change for the Future

- Starting to invest as a student may seem like a distant goal, but Acorns makes it easy for students to begin investing, even if they don’t have large sums of money to get started. The app rounds up your everyday purchases to the nearest dollar and automatically invests that spare change in a diversified portfolio.

Features of Acorns:

- Round-Up Investments: Acorns links to your debit or credit card and rounds up your purchases to the nearest dollar, investing the difference.

- Automatic Diversified Portfolio: Acorns offers pre-built, diversified portfolios based on your risk tolerance, making it a great option for beginner investors.

- Retirement Savings: Acorns offers IRAs, which allow students to start saving for retirement early, even if they have limited funds.

- Educational Resources: Acorns provides a variety of educational content to help students understand investing and make better financial decisions.

For students who want to get a head start on building wealth, Acorns is one of the best investing apps for students. The simplicity of investing small amounts of money consistently over time can lead to significant growth in the future.

5. Simple: The Digital Bank for Smart Spending and Saving

- Simple is a digital banking app that offers a combination of budgeting tools, savings features, and easy banking services—all in one place. The app is designed to make managing money simple and straightforward, with no hidden fees or complex rules. It’s perfect for students who want a hassle-free, all-in-one app to manage their finances.

Features of Simple:

- Safe-to-Spend: Similar to PocketGuard, Simple provides a “Safe-to-Spend” feature that shows how much money you have available after your goals and expenses are accounted for.

- Goals: Students can set up goals for things like saving for a vacation, a new laptop, or paying off student loans. The app helps track your progress and automatically transfers money toward these goals.

- Automatic Savings: You can set up automatic savings transfers, helping you save consistently without having to think about it.

- Cash Flow Insights: Simple provides a breakdown of your income and expenses, helping you identify areas where you can save.

With its clean design and useful features, Simple is one of the best digital banking apps for students, offering a seamless experience for managing money and budgeting.

6. Robinhood: Commission-Free Trading for Students

For students who are interested in investing in the stock market, Robinhood is one of the most popular investing apps. Robinhood makes it easy for students to buy and sell stocks, options, and cryptocurrencies with zero commissions, which makes it ideal for those starting out with limited funds.

Features of Robinhood:

- No Commission Fees: Robinhood’s commission-free structure makes it perfect for students who want to try their hand at investing without paying high fees.

- Fractional Shares: Robinhood allows students to buy fractional shares of expensive stocks, so they don’t have to buy an entire share to start investing.

- Crypto and Options Trading: Robinhood supports crypto and options trading, offering more investment opportunities.

- User-Friendly Interface: Robinhood’s app is easy to navigate, making it ideal for beginners who want to learn how to trade and invest in the stock market.

Robinhood is a great option for students who want to start investing without the burden of commissions, making it one of the best investing apps for students.

Final Thoughts : Simplify Your Finances and Take Control

- Managing your finances as a student is no easy feat, but with the help of these must-have apps for students to manage their finances, you can take control of your financial future. From budgeting and tracking your spending to saving and investing, these apps are designed to help you make informed financial decisions.

- With students budgeting tools like Mint, YNAB, and PocketGuard, you can track your expenses and stay within your financial limits. Meanwhile, apps like Acorns and Robinhood allow you to start investing early, helping you grow your wealth over time. Finally, Simple provides an all-in-one solution for students who want to simplify their banking and savings.

Start using these apps today and take the first step toward financial independence and success!

Table of Contents

FAQs: Managing Finances with Budgeting Apps for Students

1. What are the best budgeting apps for students?

- The best budgeting apps for students include Mint, YNAB (You Need a Budget), PocketGuard, Simple, Acorns, and Robinhood. Each app offers unique features to help students manage their finances, track spending, save, and even start investing.

- Mint is great for expense tracking, YNAB is perfect for those who want to take control with zero-based budgeting, and Acorns and Robinhood help students start investing early.

2. How do budgeting apps help students manage their finances?

- Budgeting apps help students by tracking their income and expenses, creating custom budgets, and providing insights into spending habits. These apps automate the process of budgeting, set savings goals, and send reminders for upcoming bills.

- By offering a clear overview of their finances, students can make informed decisions, avoid overspending, and stay on top of their financial goals.

3. Are budgeting apps free for students?

- Many budgeting apps for students are free or offer free versions. For example, Mint is completely free, making it a popular choice among students. Apps like PocketGuard and Simple also provide basic features for free, with premium features available for a fee. YNAB requires a subscription but offers a free trial for students. Always check the pricing details before committing to an app.

4. Can budgeting apps help me save money?

- Yes, budgeting apps can significantly help you save money. By providing tools to track and categorize your spending, they allow you to see where your money is going. You can set savings goals within the apps, automate savings, and identify areas where you may be overspending. This enables students to build an emergency fund, save for future purchases, or invest in long-term financial goals.

5. Which app is best for students who want to start investing?

- For students who want to start investing, Acorns and Robinhood are excellent choices. Acorns rounds up your daily purchases and invests the spare change, making it ideal for beginners. Robinhood allows commission-free trading and offers fractional shares, making it easy for students to invest in stocks and cryptocurrencies without hefty fees. Both apps provide simple interfaces, making it easy for new investors to start building their portfolio.

6. How can I budget while still having fun as a student?

- Students budgeting doesn’t mean you have to eliminate all fun activities. Budgeting apps like Mint and PocketGuard help students track their spending and allocate money for entertainment, dining, and social activities. By setting a budget for fun expenses and sticking to it, students can enjoy life while managing their finances responsibly.

7. Do I need a credit card to use budgeting apps?

- No, you don’t need a credit card to use budgeting apps, but it can be helpful if you have one. Most budgeting apps allow you to link your bank accounts, debit cards, and credit cards to track your transactions automatically. However, if you don’t have a credit card, you can still use these apps by connecting your debit card or manually inputting your income and expenses.

8. Can I use budgeting apps on my phone and computer?

- Yes, most budgeting apps for students are designed to work seamlessly across multiple devices. Apps like Mint, YNAB, and PocketGuard have both mobile apps and web versions, allowing you to manage your finances on the go or from the comfort of your computer. This cross-device functionality ensures that you have constant access to your financial data, no matter where you are.

9. How do I track my spending as a student?

- To track your spending as a student, start by using budgeting apps for students that categorize your transactions and offer insights into your spending habits. Apps like Mint and PocketGuard automatically categorize expenses and display them in clear charts and graphs, helping you visualize where your money is going. You can also set limits for each category and get alerts when you’re close to exceeding your budget.

10. What are the best investment apps for students to start growing their wealth?

- For students looking to grow their wealth through investments, Acorns and Robinhood are some of the best investment apps available. Acorns makes investing easy by rounding up your purchases and investing the change, while Robinhood offers commission-free trading and fractional shares, allowing you to buy stocks and cryptocurrencies with small amounts of money. Both apps are beginner-friendly and ideal for students who are just starting out in investing.